Offshore to Reshore: US Businesses Shift Strategies

November 2, 2022

The COVID-19 pandemic continues to change the business environment in new ways. We’ve become familiar with some changes, such as increased remote work and disruption to global supply chains. Now, we’re seeing U.S. companies increasingly protect themselves from disruptions by reshoring.

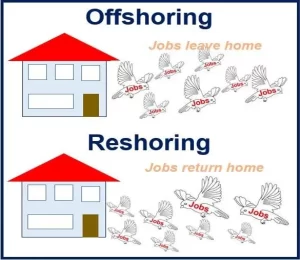

For decades, U.S. companies moved business operations and manufacturing to countries in Asia or Latin America in order to produce under cheaper and more efficient conditions—a process called offshoring. After the COVID-19 pandemic caused the collapse of global supply chains in 2021, manufacturing and distribution in many parts of the world were either interrupted or stopped completely. Numerous U.S. companies were not able to offer their clients their goods anymore because integral components or finished products could not be delivered to the United States. Although supply chain issues have calmed down in recent months, remaining lockdowns continue to affect global supply chains. For example, China, which contributed pre-pandemic roughly 20% of U.S. imports annually, is placing more and more cities under lockdown, which has caused the price of U.S. imports from China to rise dramatically due to supply bottlenecks.

To resolve issues that are ultimately but indirectly caused by the U.S. practice of offshoring, U.S. businesses are increasingly reshoring or bringing manufacturing back to the U.S. in order to decrease dependency on supply chains. The recent trend in reshoring is especially

advantageous for small businesses, which do not have the financial resources and endurance to afford doubled or tripled prices for various components they need.

advantageous for small businesses, which do not have the financial resources and endurance to afford doubled or tripled prices for various components they need.

Although the COVID-19 pandemic has catalyzed the shift from offshoring to reshoring, this trend was already emerging before the pandemic hit. Between 2010 and 2020, more than one million jobs were brought back to the United States through reshoring. The COVID-19 pandemic has brought to the forefront the inherent risks of dependence on global supply chains, which can be disrupted by a variety of factors—pandemics, yes, but also political instability and seemingly random events such as the March 2021 blockage of the Suez Canal due to a stuck container vessel.

By turning to reshoring, U.S. companies are demonstrating their ability to adapt, strengthen supply chain resilience, and diminish associated vulnerabilities. Reshoring enables businesses to react immediately to the market’s ever-changing needs thanks to the proximity of customers. Shipping costs also decrease through reshoring, although this is partially absorbed by the business to adjust for the higher cost of production in the U.S. due to higher salaries and rent. The rising tensions between China and U.S. is another incentive for U.S. businesses to reshore, as trade policy is ever-changing. For example, recently, the U.S. imposed new restrictions on U.S. companies selling advanced semiconductors to China.

It is important to note that the recent U.S. reshoring trend varies across industries. For example, the textile industry, which requires mostly manual labor, is not likely to return because of the significant wage gap between Asia and the United States.

Although reshoring is considered especially advantageous for small businesses, larger businesses are also reshoring. In December 2021, General Motors announced plans to spend upward of $4 billion USD on expanding electric vehicle and battery production in Michigan. Toyota is also about to invest $1.3 billion USD in a battery plant in North Carolina, which is expected to create approximately 1,750 jobs.

Reshoring not only helps to protect U.S. businesses from disruptions, but it also contributes to the U.S. national economy via job creation and development. Federal and state governments have therefore been keen to introduce incentives to U.S. businesses partaking in reshoring. Lastly, as U.S. businesses are increasingly scrutinized for their environmental impacts, reshoring manufacturing reduces global fossil fuel consumption from shipping.

Although the COVID-19 pandemic might be about to end, the reshoring trend is expected to remain.

Recent Posts

Posted in Uncategorized